Fraud Prevention Month is a month-long campaign in March to raise awareness about different types of fraud, how to recognize them, and how to prevent becoming a victim of fraud. Throughout the month of March, OCU will be joining other organizations, government agencies, and law enforcement bodies to provide education and resources to the…

Frequently Asked Questions

Have questions about OCU products & services? Here is a list of the most frequently asked questions – if you need more information, please contact us directly and a friendly staff member will assist you with your inquiry.

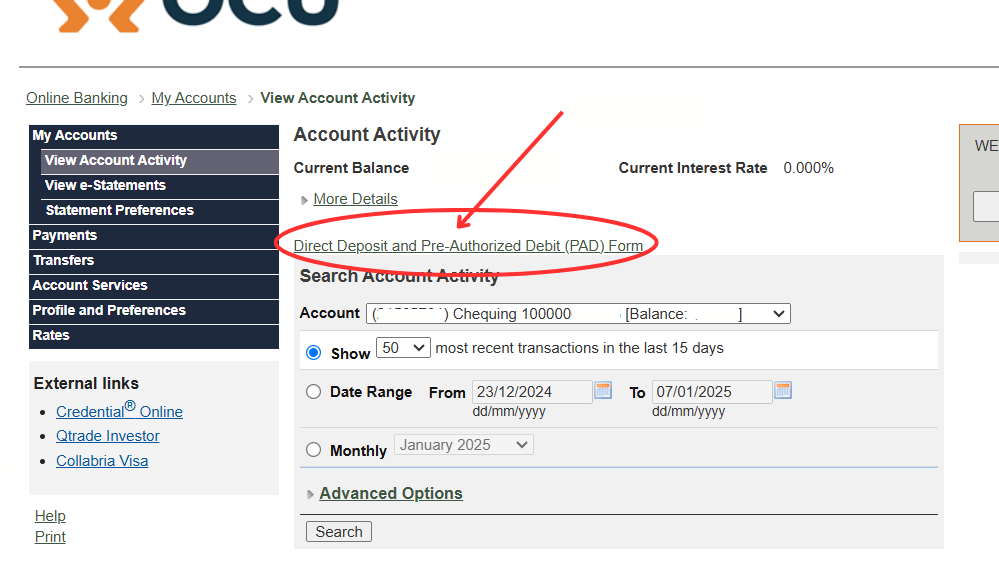

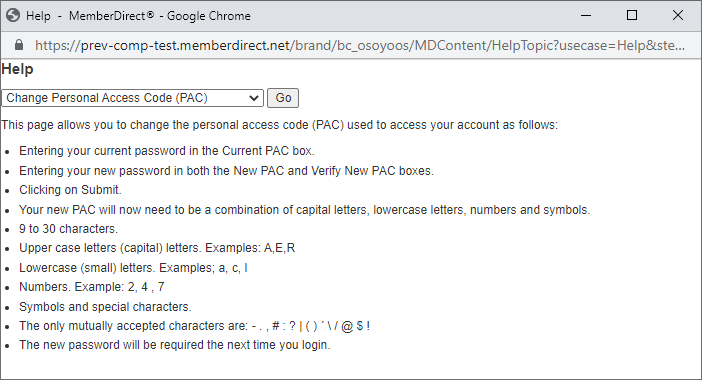

Online Banking

Monthly Statements

Transfers

Interac e-Transfers

Member-to-Member Transfers

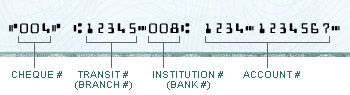

Transferring to another OCU member is almost the same and just as easy as transferring between your own accounts. First, you will need to have added the other member’s account number to your transfer list. This is done in-branch.

Once you log in to online banking, select Transfers from the left-hand side of the page. Then follow the on-screen prompts to direct you through the process- under Transfer To, select Another Member Number. You should be able to select the other member’s account number as a transfer destination.

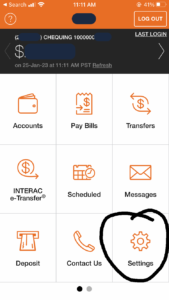

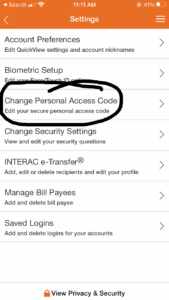

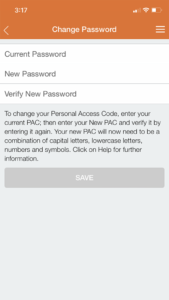

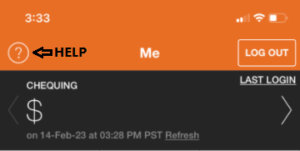

Our Mobile Banking App

You can transfer money to another member through our mobile banking app, and it’s still just as quick and easy to do.

Can’t find your question?

Send us a message! We’ll get back to you and consider adding it to this page.

Informative Blog Posts

TFSA vs. RRSP: Understanding the Fine Details

As the RRSP contribution deadline nears, the choice between Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs) becomes an important consideration. Let's look at these options and delve into a detailed comparison to help you make a well-informed decision. Both TFSAs and RRSPs offer tax advantages that can help you achieve your savings goals. If…

Confronting Debt Head-On: A Guide to Debt Consolidation

Debt can feel like a weight pressing down on every aspect of our lives, casting a shadow over our aspirations and limiting our financial freedom. Whether it's student loans, credit card debt, or multiple outstanding loans, the burden of repayments and varying interest rates can be overwhelming. Debt consolidation is one way that you…

Money on Your Mind? Let’s Talk About It!

Why We Should Talk About Money Money is a topic that often feels off-limits. Many of us grew up in households where discussing finances was seen as impolite or too personal, which has created a lingering social stigma around talking about money. Yet, breaking this taboo is essential for financial well-being and literacy. Why Money…

October is Cyber Security Awareness Month

Cyber security is always a priority, but October’s Cyber Security Awareness Month offers a great opportunity to deepen our understanding of fraud prevention and refresh our online safety skills. At OCU, we are committed to protecting our members’ financial security. This October, we’re joining the global effort to raise awareness about cyber threats and…